Sen. Grassley argues for tax reform

Since well before we became a country to the present day, America has attracted people who are willing to leave behind everything and everyone they know and settle in a strange land just to have the opportunity to work hard and provide for their families.

In fact, the colonists’ taking up of arms to condemn the British Crown’s confiscation policies was a foundational act of rebellion against the very idea of politicians spending what others earned through their own hard work and ingenuity. And it’s because of this founding genesis of our republic that we still consider policies that discourage hard work and risk-taking to be simply un-American. We would do well to approach the current tax reform debate with that understanding.

When unleashed from the yoke of burdensome tax compliance and onerous regulatory regimes, the genius of America’s free market system lifts people out of poverty to achieve prosperity far more effectively than any vaunted government program. America’s economic engine is fueled by the promise of prosperity. A look under the hood shows that the economy grows when it’s firing on all cylinders. Or as President Kennedy liked to say, “a rising tide lifts all boats.”

Landmark tax relief achieved during the Kennedy and Reagan administrations solved stagnant growth that was stalling wages and driving up unemployment. High taxes serve as disincentives to save, spend and invest. In 1962, excessive tax rates (a whopping 91 percent for the top income bracket) had a chokehold on economic growth. Following the Kennedy tax cuts, the United States enjoyed a long-term rate of economic growth that President Reagan resurrected in 1986, bringing the top rate down to 28 percent and restoring “morning in America again.”

Big spenders do their very best to scare people when talk turns to cutting taxes and cutting spending. They say we cannot pursue pro-growth tax policy because the money is needed to grow government programs. Don’t forget that every tax dollar Uncle Sam takes out of the economy is a dollar that could have been used to launch a start-up, expand a business, pay the bills or save up for a house, college or retirement.

It’s true that we need to maintain a generous safety net for those who fall on hard times, but the best way of doing that is by growing the economy rather than growing taxes. If we keep spending more money on well-intentioned government programs without growing the economic pie, we will reach a point where foreign countries will no longer loan us cheap money. Then we would have no choice but to implement harsh austerity measures like Greece, including deep cuts to safety net programs. Anyone who wants to ensure the safety net adequately serves those who truly need it ought to support pro-growth tax policy. Moreover, our goal must be to reduce the number of Americans who need the safety net by fostering an opportunity society where every family has a chance to climb the economic ladder. Tax relief primes the pump for self-sufficiency, restores the dignity of work versus soul-crushing government dependency and makes earning a living easier to achieve for the middle class.

Reinvigorating the American Dream for the next generation requires pro-growth policies that allow America to compete on Main Street and overseas. The tax framework now before the Senate Finance Committee builds on three key factors vital for economic growth: middle and working class tax relief; corporate tax reform that brings profits earned overseas back into the U.S. so companies can hire American workers and boost wages here at home; and tax relief for small business, which is responsible for two-thirds of all new job creation.

Congress has a golden opportunity, and we have a president in the White House who wants to make the tax code fairer and simpler by eliminating loopholes that create winners and losers. Free enterprise has made the U.S. into the world’s largest economy. We need a tax code that empowers hard-working Americans rather than empowering government bureaucrats or rewarding the special interests with the most lobbyists. Tax reform, relief and simplification are crucial steps we must take to recharge free enterprise in this country and secure the American Dream for generations yet to come.

It’s time for Washington to solve the riddle that bewilders millions of Americans: Why is it we are born free and yet taxed to death? Tax relief will help get our economy growing again. That means more take-home pay and better paying jobs for Americans. When it comes to taxes, less is more. That’s why I am rolling up my sleeves as a member of the tax-writing Senate Finance Committee to deliver tax relief, fairness and simplification for the American people.

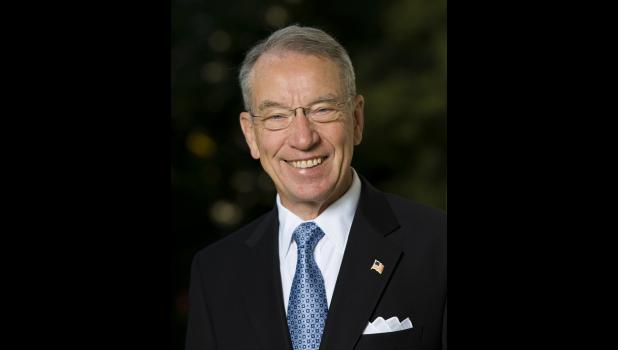

Sen. Chuck Grassley of Iowa is a senior member and former chairman of the Senate Finance Committee.